Wondering what the deal is with Cash App vs Venmo?

We’ve got you covered!

If you’re out on the town with your friends and someone suggests splitting the bill, it’s a safe bet that Cash App or Venmo will be suggested as a way for sending money.

Cash App and Venmo are both payment apps that let you send money and make transfers between their bank accounts, but they have some distinct differences.

This article will compare Cash App vs Venmo in terms of ease of use, customer service, security features, transaction limits, and more!

We will discuss:

- What makes Cash App special?

- What makes Venmo special?

- What are the requirements of both payment apps?

- What are the features of both payment apps?

- Is Venmo or Cash App better?

- Is Venmo or Cash App more popular?

- Final thoughts on Cash App vs Venmo

Then you can take what you know and figure out which app works best for you.

What Makes Cash App Special?

The Cash App is very user-friendly and easy to use.

They are also very popular among people who are new to banking and those with low balances in their bank accounts, as it charges no fees for Cash Card purchases or transfers between Cash App users’ debit cards.

No fees?

That’s right!

Cash app offers a suite of security features that Venmo does not offer, including the ability to freeze your account if you lose your phone number or password.

Cash app also has excellent customer service – they’re able to answer questions about technical issues via email within 24 hours as well!

You can also take a look at our guide to Cash App hacks.

What Draws People To Cash App Over Venmo?

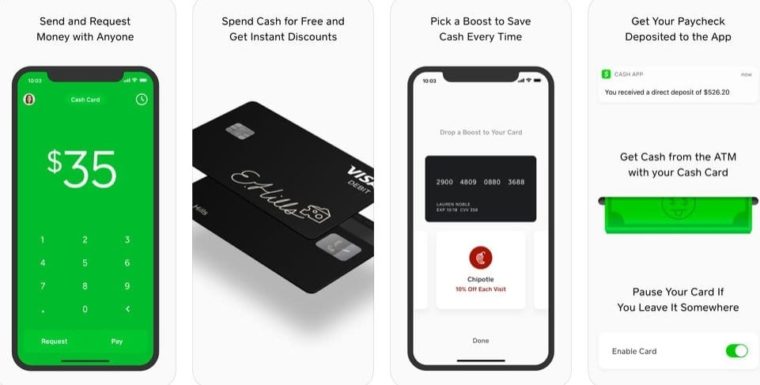

The Cash Card is accepted everywhere Visa is accepted.

And…

…It features the best of both worlds with being able to withdraw cash from ATMs or use your card at retailers without paying ATM fees like some other cards charge.

Cash App Borrow offers the ability to get a small loan quickly if you need one–without complicated paperwork–is something many are drawn to when comparing these two apps.

Venmo does not offer any loans.

What Makes Venmo Special?

Venmo lets users send money instantly with just a phone number and email address instead of needing bank accounts linked together like Cash App does.

You can also create groups on Venmo where everyone pays into one pot as long as they know the password.

Venmo also offers the ability to post on social media about transactions in a public feed.

Cash App does not currently offer that functionality, which can be an advantage for people who want to keep their expenses separate.

What Draws People To Venmo Over Cash App?

Cash App does not currently offer the ability to create groups.

Cash App has a limit of $2000 per day when transferring funds, while Venmo allows transfers up to $25000.

Other differences between Cash App and Venmo are worth considering before choosing one over another for your transactions.

Cash app is free if you use it with friends or family members but can cost 0.99% + 30¢ per transaction otherwise.

Venmo also offers an option where users can request money from others without knowing their phone number–through this feature costs more than sending fees would on Cash App (0.75% versus 30¢).

There’s no monthly fee with either service though some banks may charge them depending on the circumstances.

What Are the Requirements of Both Payment Apps?

To use Cash App you are required to be at least 18 years old and have a valid Cash App account.

To use Venmo, you need to be 18 or older with an e-mail address where they send payments in your name (unless it is being used for transferring funds between friends).

A Cash App user can also add their bank card so that they are able to transfer money through the Cash App without purchasing from cash.

Now that’s convenient!

With Venmo there isn’t this feature–users must purchase using either PayPal or any other payment service which may come with a transaction fee attached.

Venmo doesn’t allow adding bank cards as well but does offer peer-to-peer transfers via email-like addresses shared by users who don’t know each other’s phone numbers.

That’s a great feature too.

These transactions are very quick and don’t require as much verification.

Cash App, on the other hand, requires authorization from either a fingerprint or Face ID scan to complete payments. [1]

In order to receive money with Cash App, you need to link your Cash App to a checking account or debit card.

Cash app users can also add their bank cards so that they are able to transfer money through the Cash App without purchasing from cash.

With Venmo there isn’t this feature–users must purchase using either PayPal or any other payment service which may come with a transaction fee attached.

Can You Use Credit Cards or Prepaid Cards?

Venmo accepts major credit cards, prepaid debit cards, and bank transfers.

Cash App does not accept credit cards or prepaid cards but does accept bank transfers.

What Are The Features of Both Payment Apps?

Cash app users have access to tools that help them budget their spending and find out how much they’ve saved since downloading Cash App.

Great for saving money!

Venmo doesn’t offer anything like this but does allow you to set up reminders of when your friends owe you money–this feature comes in handy if there’s no way of contacting someone via phone number or email address.

Venmo also has a unique feature called “Recurring Payments” that allows for people to have their payments automatically deducted from their accounts on a regular basis. [2]

Super convenient, yes?

Cash app doesn’t offer this option but does allow users to set up reminders of when they need to make payments which can be helpful if you’re trying to budget your spending.

Or avoid late fees!

There are many more features available with both Cash App and Venmo–for example, Cash App lets you send or request money using emojis!

Cash app also has Cash Card boosts that let you save money instantly when you use your Cash Card at coffee shops, restaurants, and other merchants.

There are also a few other apps similar to Venmo out there and other good alternatives to Cash App as well.

Is Venmo or Cash App better?

Depending on what you use the Cash App for, Venmo might be better.

Cash app tends to charge a bit more per transaction if you’re using it with people other than friends or family members and offers a lower limit for transfers as well–$2,000 versus $25,000 on Venmo.

Cash app shines with its easy-to-use interface and simple transaction process.

It may be the best choice for you if you want to keep things simple.

What are Cash App and Venmo Fees?

Cash App charges a flat fee of $0.25 for transactions under $20, which is waived if you do more than 20 Cash App transactions per day.

And Venmo?

They don’t have any transaction fees unless the sender pays a bank transfer or ACH fee (which are typically less expensive).

Also, they don’t have any limits on how many times someone can send money in one day.

How Long Do Transfers Take?

Cash app is an instant transfer while Venmo takes a few hours.

Cash App offers faster transfers than Venmo and allows for up to $25,000 per transaction.

Bank account transfers are also quick for both Cash App and Venmo, taking two to three business days.

Who Has Better Customer Service for a Mobile App?

Cash App offers phone, app, and web support, while Venmo has a customer service chatbot.

Cash App’s FAQs are the best resource for certain situations such as:

- If you lose your Cash Card

- You forget your password

- How to send money internationally and receive it in other currencies

Cash App’s Cash Help desk is also available to provide support for common questions.

Venmo offers live customer service through phone, chat, and email with a team of professionals who are always on hand to answer any queries you might have.

The only downside?

Their staff may not be as knowledgeable about other platforms such as Cash App or Apple Pay, so there can be some frustrations when trying to get information specific to those services.

Which Payment App is Safer to Use?

Cash App has never been hacked while Venmo was the victim of one major hack in 2018 which compromised tens of millions of accounts.

Both the Cash App and Venmo offer security features such as Touch ID logins or two-factor authentication (via text message).

Cash App’s cash-out system also provides additional protection so that you can’t spend money in your account without entering your physical debit card PIN into a prompt on their smartphone app before making transactions with it.

Safety first!

Which Apps Work Internationally?

Cash App is available in the United States and the United Kingdom.

Venmo works with the U.S., Europe (in many languages), and Mexico while Cash App can’t be used internationally.

Cash App can only be used to send money to the country you live in.

You cannot use it to send money to someone else in a different country than you.

Is Venmo or Cash App more popular?

Venmo has the most downloads of any app on Cash App’s competitor list.

According to Statista, as of December 2018, Venmo had over 100 million active monthly users.

Cash App only had about 50 million.

Cash App is still growing quickly though and doubled its number of transactions in just six months from 2017-2018.

As of 2021, Cash App has grown significantly to be the most popular app for making payments while Venmo has been seeing steady growth but just not on the same level as Cash App.

Cash App vs Venmo Market Share Compared

Venmo has about a two-thirds share of the U.S. Cash App market.

And Cash App?

They’re holding it down in the United Kingdom and Canada with almost 90% of the market share for those countries.

Cash App vs Venmo Active Users Difference

Cash App has a higher percentage of use among males, with 24% more active users than Venmo.

Cash App’s user base is younger and larger in the 18-24 age demographic.

Final Thoughts On Cash App vs Venmo

Cash App is the latest and greatest in mobile payment apps.

Cash App does have a few advantages over Venmo:

- It’s easier to send funds back if you’ve made an accidental transfer

- They have added functionality for paying bills

- Cash App transactions are available instantly on your bank account (Venmo requires a three-day waiting period)

Ultimately, both services are great options and will depend largely on what type of activities you’ll use them for.

Whether Cash App or Venmo may be best depends heavily on how often you transfer money between individuals outside your network of friends and relatives.

Happy spending (and saving)!